When Insurers Choose, Patients Lose: Peak Bodies

Private health sector peak bodies have slammed the proposal of a “hardship package” by the corporate health insurance industry as a ‘nonsense’ plan that fails to address the serious viability challenges of Australia’s private health system.

The peak bodies, which include the Australian Private Hospitals Association (APHA), Catholic Health Australia (CHA), and the Medical Technology Association of Australia (MTAA), have criticised the proposal being floated by the corporate health insurers as a smoke and mirrors tactic.

The organisations say this is a blatant attempt by insurers to avoid their public-good obligation of returning a minimum of 88 cents in the dollar of their customers’ premiums. The organisations also consider Private Healthcare Australia’s (PHA’s) claim that further cuts to life-saving medical device benefits will improve hospitals' viability is false.

Analysis from the independent Nous review, commissioned by the Department of Health and Aged Care, revealed savings of approximately $290 million in medical device benefit reductions between Jul 2022 and June 2024, which health insurers have failed to honour their promise to pass on these savings to customers.

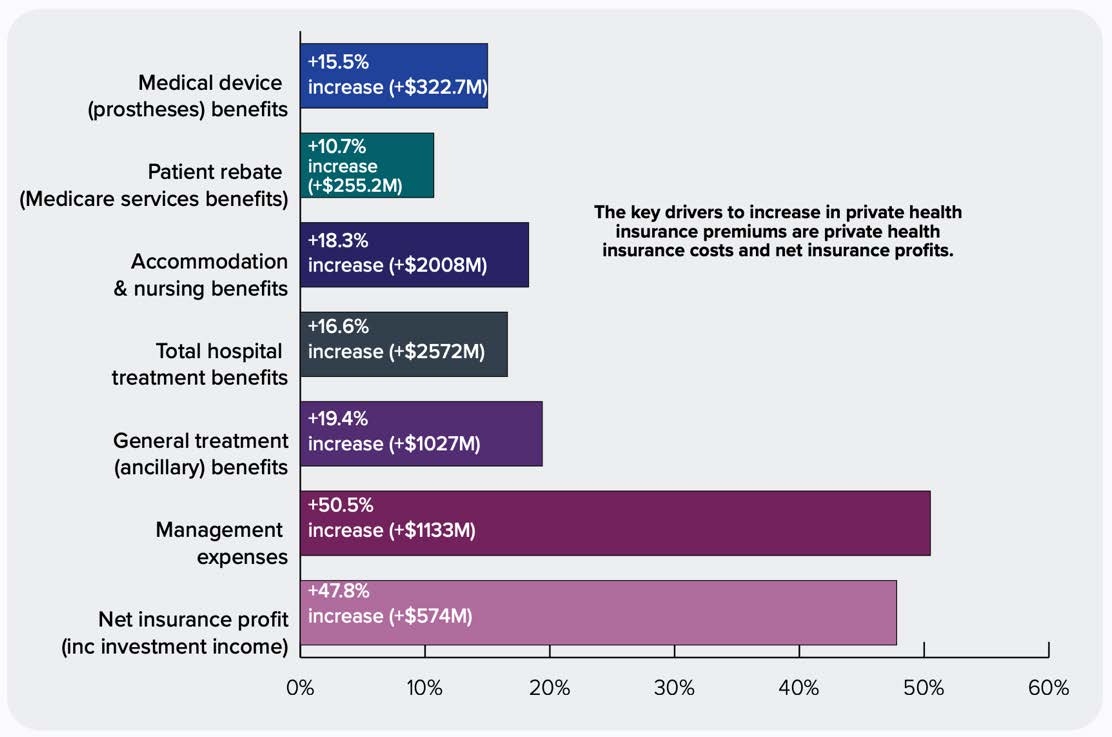

FIGURE: How increased private health insurance premiums have been spent in the five years to June 2024.

Source: Australian Medical Association Private Health Insurance Report Card 2024 https://www.ama.com.au/articles/ama-private-healthinsurance-report-card-2024

Instead, insurers have redirected these savings to themselves through increased profits and management expenses, including executive salaries, bonuses, luxury office spaces, and marketing budgets.

The peak bodies consider this failure yet another example of a troubling pattern of behaviour from health insurers, aimed at transforming Australia’s private health system into a US-style managed care model, in which a few insurers control private hospitals, limit patients' choice of doctor, and dictate which medical devices doctors can use in surgery.

If successful, corporate health insurers would gain complete control over the health decisions of privately insured Australians, resulting in lower standards of care, deteriorating health outcomes, and disproportionate financial and political influence over health system decisions.

The peak bodies are urging the public to support the Government’s plans to lower health insurance premiums and restore accountability by requiring private health insurers to pay at least 88 cents per dollar to private hospitals and ensure medical device savings are passed on to patients, in full, through public reporting.

To achieve this, the Government should:

- Establish an independent body to oversee insurer practices threatening the system’s viability and the value of private health insurance,

- Cap capital requirements to compel insurers to release excessive reserves to support the struggling health system, and

- Include rising care delivery costs and factors like insurer profits and management expenses in future premium round processes.

APHA CEO, Brett HeIernan, said:

“Federal Health Minister Mark Butler’s public commitment to addressing the massive shortfall in funding by insurers, and ending their dominance in contracting over hospitals, is the core issue that is causing the viability crisis impacting hospitals, their services and, ultimately, patients.

“Nothing less than insurance companies paying their way will do. The insurers are making record profits. They can afford to meet their responsibilities to fund the healthcare of their members in full without any increase in premiums."

MTAA CEO, Ian Burgess, said:

“The large corporate insurers’ share prices are climbing because of their bumper profits. The Minister for Health has called out their price gouging, and now insurers want to gouge even more by further cutting benefits for life-saving medical devices.

“In contrast, despite MedTech only accounting for 8% of insurers’ revenue, our industry has more than done its part, enduring significant cuts and delivering savings totalling almost $290 million in the last two years alone—savings that insurers have simply pocketed. It’s well time health insurers paid their fair share.”

CHA Director of Health Policy, Dr Katharine Bassett, said:

“The Prescribed List is not the place to look for more savings. We’ve already seen significant reductions in benefits paid for medical devices, yet those savings were not passed on to patients. Instead, insurers pocketed the difference. “It’s clear insurers are prioritising their profits over patients. The way we fund care in the private sector needs to be reformed so private health insurers can’t continue to siphon money away from hospitals and patient care.”

Media Contacts:

- APHA: 0422 337 867 Lilly.tawadrod@apha.org.au

- CHA: 0416 426 722 Anil@hortonadvisory.com.au

- MTAA: (02) 9900 0600 media@mtaa.org.au