Key Points

- Membership of private health insurance has been slowly declining

- This is driven by cost and competition from the public sector

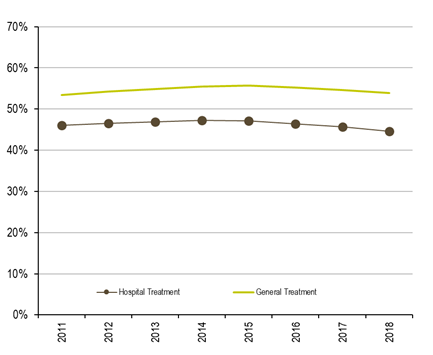

While large numbers of Australians have private health insurance (44.6% hospital cover, 53.9% general cover), membership has faced declines in recent years. Nearly 3% fewer Australians have hospital cover in December 2018 than in 2015. General cover has also been declining. Generally, it is the young and healthy who are not joining or are leaving health insurance. See graph below.

Why is this? There are several reasons:

COST - The cost of healthcare has been increasing due to ageing, chronic disease, higher expectations and improvements in treatments. Like all healthcare expenditure, public and private, insurance premiums have been growing on average at over 5% per annum since 2013, higher than the rate of inflation or wages growth. Consumers feel the cost increase and weigh up whether to remain members, even with incentives in place. In contrast, governments are lauded when they increase funding for the public hospital and healthcare sectors which overall has been growing at a similar rate or faster. The cost of this is hidden in taxation revenue.

COMPETITION – The direct competitor of private health insurance, particularly for hospital cover, is Medicare. Governments have been investing in hospital infrastructure across Australia in recent years, resulting in many new hospital buildings and other infrastructure. Consequently, public hospital treatment may start to appear more attractive than private hospital treatment.

REGULATION - Private health insurers are significantly hamstrung under current regulation from investing in prevention or new models of care that could tackle the rising tide of chronic disease, or find alternatives to expensive hospital treatment

INEFFICIENCES – Private health insurers have been growing revenue in the last two decades but there has been little improvement in their administration costs as a proportion of premiums received or benefits paid.